DeFi Protocol Maverick Protocol Unveils UniSwap Rival Decentralized Exchange on the Ethereum Blockchain with Novel Automated Market Maker

The protocol is powered by a native smart-contract-based, automated market making (AMM) engine the Maverick team had been building for over a year and lets investors earn more revenue than on UniSwap, one of the top DEXs, Bob Baxley, Maverick’s chief technology officer, told CoinDesk in an interview.

DEXs are built around liquidity pools, where traders can exchange assets while investors – also called liquidity providers – earn rewards from transaction fees for providing liquidity to make a market. Liquidity distribution is the price range where investors deploy their capital for the pair of assets in the liquidity pool. Naturally, investors are attracted to deploy their capital on protocols with higher, steadier rewards.

DEXs are built around liquidity pools, where traders can exchange assets while investors – also called liquidity providers – earn rewards from transaction fees for providing liquidity to make a market. Liquidity distribution is the price range where investors deploy their capital for the pair of assets in the liquidity pool. Naturally, investors are attracted to deploy their capital on protocols with higher,steadier rewards.

“If liquidity providers in existing AMMs want to keep their capital as active as possible, they are forced to adjust their liquidity positions hourly, costing them time and gas,” Baxley said. “By giving LPs the option to choose if and how their liquidity moves with price in a given pool – something that no other AMM does natively – Maverick enables markets to run more efficiently, resulting in more consistent fee generation.”

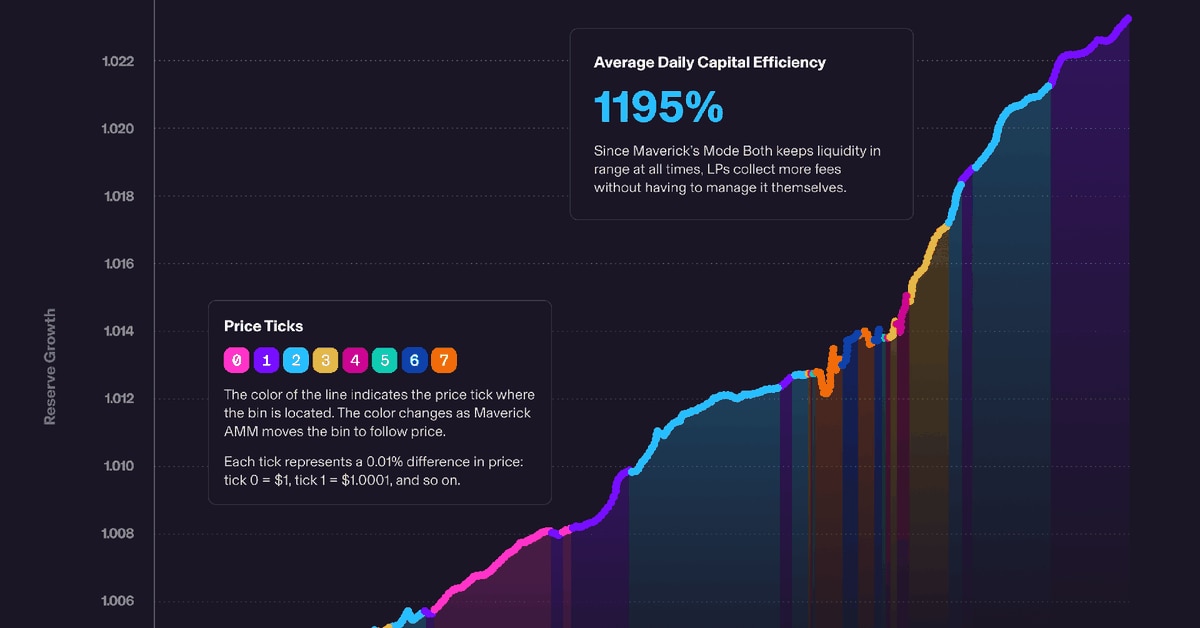

In a backtest for last month, Maverick claimed the strategy reached 1,195% of average capital efficiency without any inactive periods, which translates to about ten times more potential income for liquidity providers compared to UniSwap.

This content was originally published here.